The promise of streaming TV was direct-to-consumer (D2C) with few gatekeepers.

The reality of streaming TV is hardware providers taking the place of cable TV companies as gatekeepers in distribution battles.

Exhibit A: NBCUniversal and Samsung have yet to agree to terms for Peacock.

Why this matters: Two wars are raging that will decide the future of TV distribution.

The war for consumer attention: Smart TV manufacturers (Samsung, LG, etc.) and streaming hardware providers (Roku, Amazon, etc.) are competing to be the default portal for consumer access to streaming content.

The war for streaming app/content distribution: Smart TV manufacturers and streaming hardware providers use this leverage to negotiate distribution deals with streaming apps for a share of their ad inventory and subscription revenue.

The bottom line: A higher share of consumer attention → More leverage in distribution deals → More money

Flashback: The Smart TV Wars Heat Up

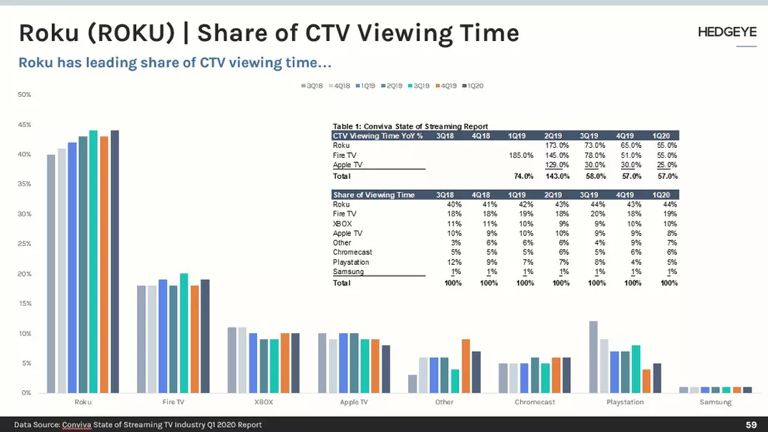

Big question #1: Who is winning the battle for consumer attention?

Quick answer: Streaming hardware providers dominate time spent with streaming apps, but smart TV providers are gaining ground with a higher share of device sales.

Share of CTV viewing time in 2020-Q1 according to Hedgeye:

1) Roku – 44%

2) Fire TV – 19%

3) XBOX – 10%

4) Apple TV – 8%

5) Other – 7%

6) Chromecast – 6%

7) Playstation – 5%

8) Samsung – 1%

U.S. streaming device sales (% of total) during 2020 according to the Consumer Technology Association:

U.S. streaming device sales (% of total) during 2020 according to the Consumer Technology Association:1) Smart TVs – 39M (65%)

2) Streaming devices – 21M (35%)

Quick math on revenue from branded streaming service buttons:

1) 60M streaming devices sold in 2020

2) ≈ 4 streaming buttons per remote

3) ≈ $1 per button for each device sold

4) $240M in revenue

Hisense is shipping a remote with six buttons, including the following streaming services:

1) Netflix

2) Amazon Prime Video

3) YouTube

4) Tubi

5) Disney+

6) Peacock

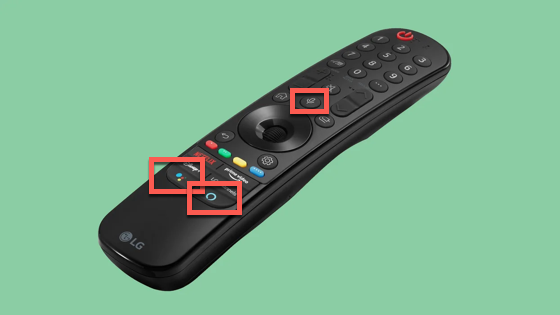

Smart TV manufacturers such as LG and Samsung are forgoing a portion of that initial revenue to keep space for a branded button promoting their ad-supported streaming services.

Quick math on tradeoff for Samsung/LG keeping space for their own branded button:

1) 4 minutes per hour of ads

2) 8 30s spots per hour

3) ≈ $30 CPM

4) $0.24 per hour

5) 4.2 hours of ad-supported viewing is the break-even point

The battle to be the default voice assistant: Amazon and Google have taken their voice assistant battle to the living room.

LG is offering 3 different voice assistants on its remote, including:

1) Amazon Alexa

2) Google Assistant

3) LG webOS

The battle to build a universal guide: As the number of streaming services grow, it has become more challenging to find content without searching through individual apps. A universal guide would allow the user to search all apps for a specific program and offer curated recommendations.

The problem is everyone is not playing nice here either. For example, Netflix recently forced Google to remove their original programming (The Crown, etc.) from Google’s universal guide for Android TV.

Good news: Multiple companies are trying to solve this exact problem, including Bingie, JustWatch, and Reelgood.

Why this matters: TV prices are down 60% since 2014, and smart TV manufacturers are building alternative revenue streams (advertising, etc.)

Average size (inches) of TVs sold in the U.S. (YoY growth) according to NDP:

1) 2018 – 47

2) 2019 – 49 (↑ 4%)

3) 2020 – 51 (↑ 4%)